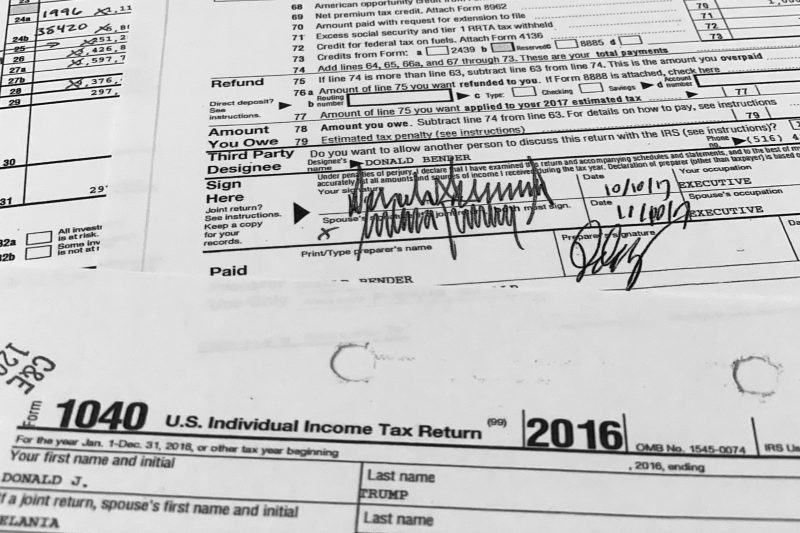

In March 2021, a former tax consultant to the Internal Revenue Service (IRS) was arrested and charged with leaking confidential and private tax return information to the media regarding President Donald Trump and other wealthy Americans.

James W. Clarke was taken into custody by federal agents and charged with five counts of violating provisions of the federal Taxpayer Privacy Act. According to federal prosecutors, Clarke leaked private information about the federal income taxes of not only Trump, but of several wealthy US individuals. Clarke allegedly received a financial reward from the media outlets to which he illegally provided the data. He faces over 25 years in prison if convicted.

The leak blowback was swift and led to calls from the IRS, Justice Department, and other agencies for stronger data security and improved investigation capabilities. Taxpayers are now advised to keep their tax returns carefully guarded and stored securely to avoid similar incidents in the future. The IRS has also implemented a series of technology and policy changes to better protect confidential tax data, as well as ensure that all criminal activity related to improper disclosures of taxpayer information is prosecuted.